Britain's Looming Fiscal Storm

The OBR's Stark Warning on Debt, Pensions, and Net Zero Costs

Today I will look at the UK's financial landscape as discussed in the latest report from the Office for Budget Responsibility (OBR). The report provides a detailed picture of Britain's economic health, highlighting the significant costs of the Net Zero transition.

The UK's public finances are in an "unsustainable position in the long run", facing an "array of promises" that the nation "cannot afford".

This is the stark warning from the OBR in its latest Fiscal risks and sustainability report, published in July 2025. This damning verdict on Britain's economic health comes amidst rising debt, an ageing population, and the escalating costs of transitioning to a net zero economy.

A Vulnerable Economic Landscape

The OBR's report paints a bleak picture of Britain's fiscal resilience. At the end of 2024, the UK's government deficit stood at 5.7 per cent of GDP, which is approximately 4 percentage points higher than the advanced-economy average. This positions the UK with the fifth-highest among 36 advanced economies. Similarly, UK government debt, at 94 per cent of GDP, is the sixth highest among advanced economies overall. This elevated debt, coupled with interest rates that place the UK government facing the third-highest borrowing costs among advanced economies (after New Zealand and Iceland), underscores its "increasingly vulnerable" position.

The OBR laments that successive governments have made "only limited and temporary success" in putting public finances on a sustainable footing. Public sector net borrowing has consistently hovered around 5 per cent of GDP for the past four financial years. Despite various fiscal frameworks aimed at reducing debt, underlying public debt has surged by 24 per cent of GDP over the last 15 years and 60 per cent over the past two decades.

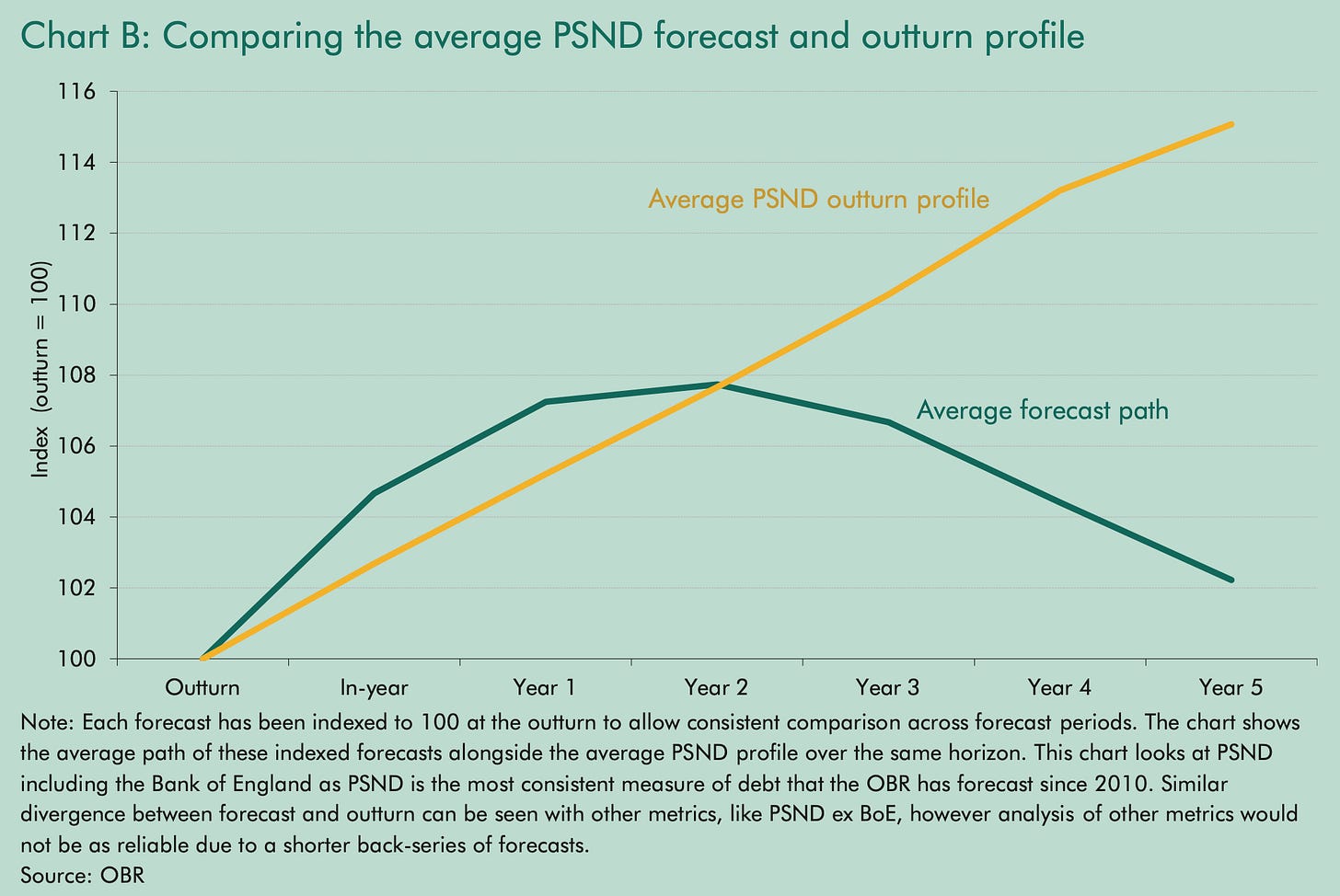

This persistent upward trend, as illustrated above in the OBR's Chart B above, compares actual Public Sector Net Debt (PSND) out-turns with previous forecasts. It demonstrates a consistent pattern where debt rises further than anticipated. This erosion of fiscal capacity leaves the UK less able to respond to future shocks.

The State Pension Triple Lock: A Costly Promise

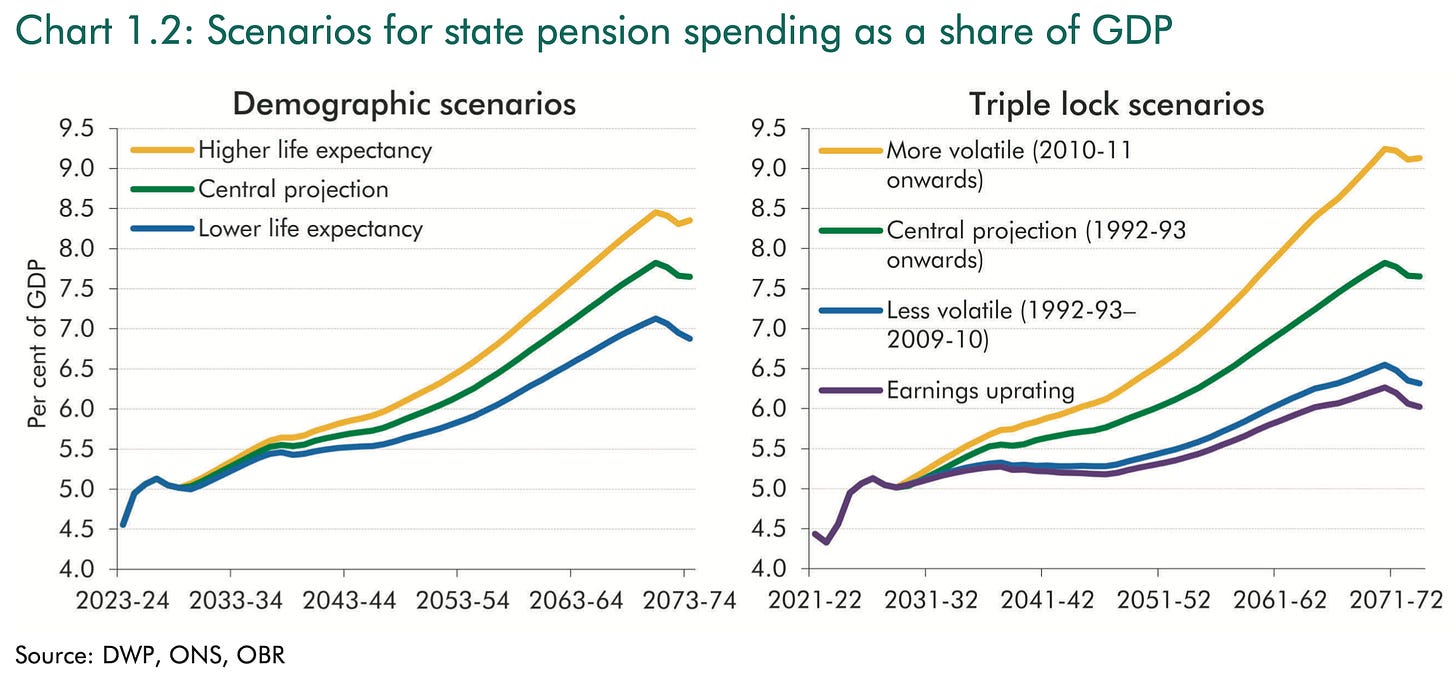

One of the most significant long-term fiscal pressures identified by the OBR is the state pension triple lock. This mechanism, which uprates the state pension by the highest of earnings growth, inflation, or 2.5 per cent, is a major driver of increasing expenditure. The OBR projects that what was initially expected to cost taxpayers £5.2 billion annually by the end of the decade could now reach £15.5 billion a year by the next election.

Looking further ahead, a volatile economy could push this annual cost to a staggering £43 billion by the early 2070s. The OBR's Chart 1.2 below emphasizes how different scenarios for earnings and inflation volatility significantly impact state pension spending as a share of GDP.

Beyond the direct costs, the OBR highlights a more indirect fiscal risk stemming from the shift from Defined Benefit (DB) to Defined Contribution (DC) private pensions. DB schemes, traditionally significant holders of UK government debt (gilts), are winding down, with 86 per cent of private sector DB scheme members now in schemes closed to new joiners.

Therefore, we are transitioning to a future where pension schemes will purchase a much smaller share of gilts than is the case today. The OBR projects that total pension scheme gilt holdings as a share of GDP could fall by 18.6 percentage points by the early 2070s.

This is not an academic measure. The decline in demand for gilts could push up interest rates on government debt by around 0.8 percentage points, potentially increasing debt interest spending by £22 billion in today’s terms, assuming debt remains at 100 per cent of GDP. If government debt continues to rise above these levels, the upward pressure would be even greater.

The Financial Demands of Net Zero

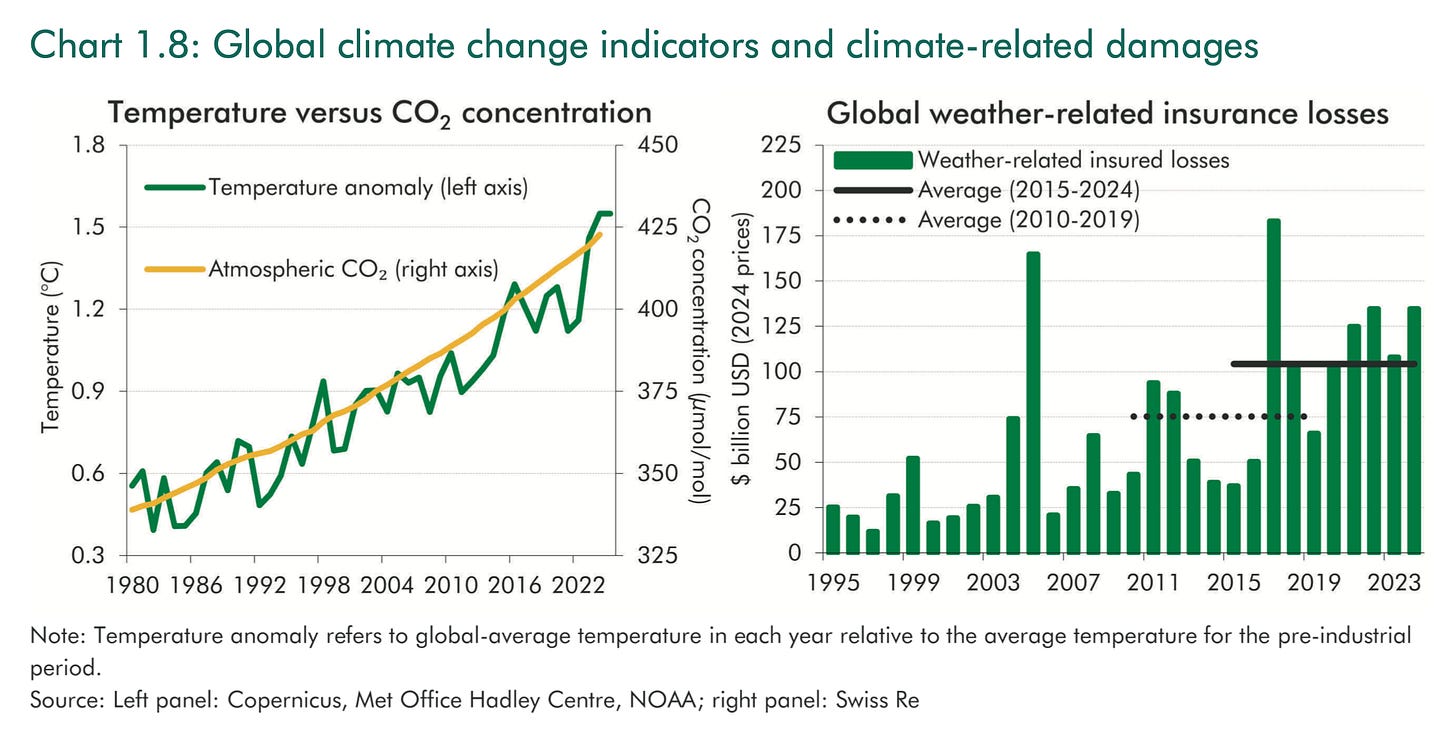

Then we come onto my favourite topic. The OBR sets the scene with these lazy charts:

Firstly, Carbon Dioxide is shown to be in lockstep with global temperature. Apart from the obvious argument that correlation does not mean causation this is a comedically short window to compare the two, given the earth is 4.5bn years old.

However, the insurance loss chart is the one that really matters for our discussion today. It's true to say that insurance losses have increased over time but it’s highly misleading if we don't factor in the impact of living in a much more prosperous society. The consequence is that we all own much more stuff that can be damaged.

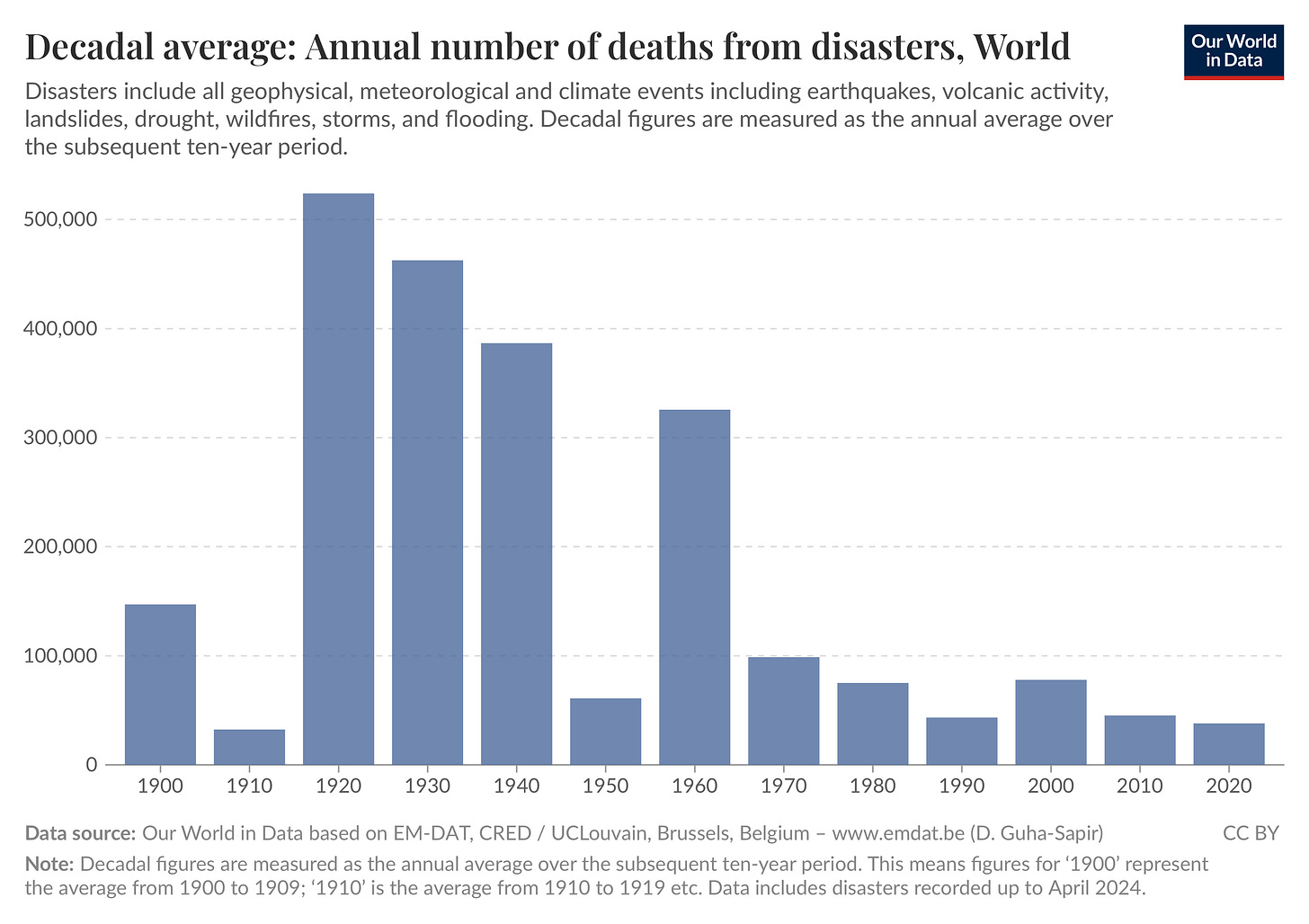

In support of my argument consider the following chart from Our World in Data showing the declining trend in deaths world-wide since 1900. I.e. despite rising insurance claims, human life has never been less threatened by climate change.

Therefore, the OBR’s climate scene setting is both unhelpful and misleading. Claims may be going up but our more prosperous society is not only delivering more stuff but also providing greater resilience to disasters. This ought to be a cause for celebration!

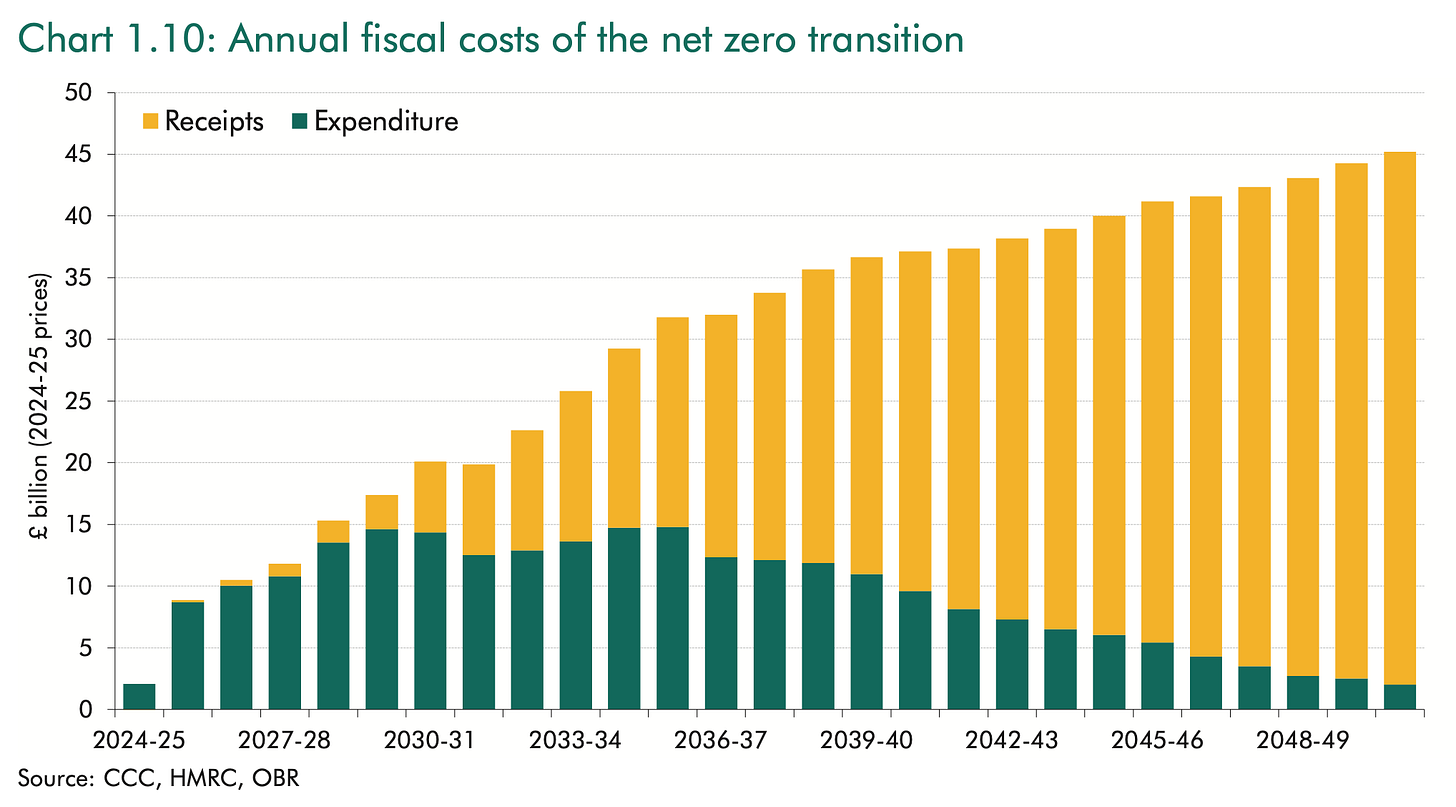

That being said, the OBR argues that Britain's commitment to net zero also presents substantial fiscal challenges. It estimates that the transition will cost taxpayers over £800 billion over the next two decades, averaging roughly £30 billion annually until at least 2051. This includes nearly 9 billion a year for infrastructure investments (like updating the electricity grid) and a significant £20.5 billion in lost revenue from declining fuel duty as electric vehicles become more common.

The OBR notes that these lost tax receipts will eventually become the larger fiscal factor (see chart 1.10 above). This projected loss of fuel duty, as pointed out by The Telegraph, "opens the door to potential pay-per-mile road charges for all vehicles to maintain tax revenue".

While substantial, this £800 billion figure is a downward revision from the OBR’s 2021 estimate of £1.1 trillion. This reduction, as explained by the OBR and the Telegraph, is largely due to the CCC's "downward revisions to the whole-economy costs of transition," as well as "fuel duty freezes leading to lower lost receipts and a higher-than-expected uptake of EVs".

However, David Turver points out that the OBR "simply parrot the numbers from the Climate Change Committee (CCC)" regarding the overall net cost of Net Zero for the whole economy. The CCC estimates this to be just £116 billion by 2050. Turver also notes that this "huge cost to the public purse even assumes carbon taxes rise from £42/t to a staggering £328/t in 2050/51" - an almost 8x increase! What Turver is saying is that if you think the Net Zero element of the forecast is grim, the actuality will be significantly worse.

Beyond the direct costs of mitigation, climate change itself poses significant financial risks. The OBR warns that a rise of 3 degrees Celsius in global temperatures could lead to lower economic growth and add 74 per cent of GDP to government debt by the early 2070s. At this point we must take a breath and understand that this is made up nonsense.

Do we see GDP in Dubai being relatively down-weighted by their considerably average higher temperatures? There is simply no basis for this forecast when as we become richer we become more resilient to natural or man-made extreme weather events. The absolute best thing we can do to protect ourselves from climate change is to make ourselves richer. The OBR and unfortunately successive governments, simply do not understand this.

However, and critically, the OBR does state that:

unlike transition costs, there is little the UK can do to directly reduce these costs, as they are driven by the impact of global climate change, and so by how much major global emitters reduce their emissions over the coming decades.

When was the last time you heard Ed Miliband or anyone else in government admit that our Net Zero policies are doomed to failure? Make no mistake - that is exactly what the OBR is saying here.

Other Notable Fiscal Pressures

The OBR's report also touches on other significant fiscal risks, indicating that the overall risk landscape has intensified since their 2023 report. These include:

Geopolitical Tensions: The crystallisation of geopolitical risks means upward pressure on defence spending, with the UK committed to increasing it to 3.5 per cent of GDP by 2035 (on core defence). Rising global trade tensions, particularly from shifts in US trade policy, could also significantly impact the UK economy, with a 20 percentage point increase in US tariffs potentially increasing the UK's current budget deficit by around £10 billion a year. Cyber-attacks, like recent incidents affecting the Legal Aid Agency and HMRC, also pose a growing fiscal risk, capable of increasing borrowing by 1.1 per cent of GDP in the year of a major attack.

Health and Welfare Spending: Persistent increases in health-related welfare caseloads, with 780,000 more working-age people classified as inactive than pre-pandemic levels due to long-term sickness, pose a significant risk of increased welfare spending and lost tax receipts.

Local Authority Financial Sustainability: Local authorities face growing pressures from statutory and demand-led services, with some at risk of declaring bankruptcy without central government support.

Uncertain Tax Yields: The tax-to-GDP ratio is forecast to reach a historic high of 37.7 per cent by 2027-28. However, the estimated yields from several recent policy measures, such as personal tax threshold freezes and reforms to the non-domicile regime, are highly uncertain and sensitive to economic conditions or behavioural responses. Who would have guessed that? Well, just about anyone not in our current government.

Conclusion

The OBR’s latest report paints a challenging and interconnected fiscal landscape for the UK.

The combination of structural vulnerabilities, costly long-term commitments like the state pension triple lock and the significant financial demands of climate policies (which the OBR underestimates), pose a formidable challenge to public finances.

The warning is clear: without difficult policy choices, the UK risks an unsustainable debt trajectory and a reduced capacity to navigate future shocks.

One could put it in more earthy terms - but you know what I mean.

Sources

Fiscal risks and sustainability – July 2025, Office for Budget Responsibility, July 2025, https://obr.uk/frs/fiscal-risks-and-sustainability-july-2025/

OBR Falls for Fake CCC Numbers, David Turver, 9th July 2025,

Net zero to cost taxpayers £800bn, Eir Nolsøe, The Telegraph, 9th July 2025, https://www.telegraph.co.uk/business/2025/07/09/net-zero-cost-taxpayers-800bn/ (paywalled)

Decadal average: Annual number of deaths from disasters, World (up to April 2024), https://ourworldindata.org/natural-disasters