Shooting the horses - metaphorically!

The clean energy transition appears to be working for very few in the UK, not even for the clean energy sector itself.

This post is a follow up to my article Letter to my MP regarding the impact of New Zero policies on workers. My MP, Elsie Blundell, replied promptly providing the following response from a parliamentary question to MP Michael Shanks, Parliamentary Under-Secretary of State for Energy. He said:

The Government is committed to a managed just transition for the North Sea, supporting affected regions and communities as the energy system evolves. It recently consulted on ‘Building the North Sea’s Energy Future’ to unlock long-term clean energy investment in the basin while delivering economic opportunities across the affected regions. A response setting out its next steps will be published in due course. The Office for Clean Energy Jobs will continue to coordinate work to support building the skilled workforce we need for the clean energy and net zero transition.

I was surprised that they are considering a future for North Sea energy but when you look at their consultation they make clear it’s about transitioning North Sea oil and gas jobs to clean energy jobs.

What are the chances I wonder for a “just” and “managed” transition? I was also surprised that we have an Office for Clean Energy Jobs. And I could make no sense of “unlock long-term clean energy investment in the basin”. This may be explained in the full report and I’ll try and look at this when it comes out.

This reply did made me realise is that I had ignored what’s going on in the clean technology sector, particularly the manufacture of wind turbines and electric vehicles. It doesn’t take too much research to find out that the clean energy transition in the UK is proving to be complex and challenging. It appears to be characterised by significant job losses and financial distress.

Electric vehicles (EVs) and renewables face their own set of substantial hurdles and a lack of coordinated support. This combination of factors suggests that the transition is currently not working for many stakeholders across the UK.

Problems in Traditional Industries

The UK's traditional industrial sectors, particularly oil and gas and wider manufacturing, are facing a severe and accelerated downturn. I’ll cover a few examples here.

Oil and Gas Sector Decline

Scotland's only oil refinery, Grangemouth, is to close by summer 2025, leading to the loss of 400 jobs. Petroineos, the company, cited its inability to compete with more modern sites in Asia, Africa, and the Middle East, a decline in demand for key fuels, and the high cost of maintaining a half-century-old refinery. A key lesson from this situation is that companies will inevitably balk at further investment when their sector is under a death sentence.

According to the BBC “union leaders had hoped that the central Scotland facility could remain open for longer to provide time for a greener fuel alternative to be established at the site”. They went on to say that the move was a "national disgrace" and accused the UK and Scottish governments of being "missing in action".

The refinery has been losing approximately £400,000 a day and is projected to lose around £153m in 2024. The conversion of the site into an import terminal will require fewer than 100 employees, down from the current 475. This transition is described as "neither just nor attractive for those at the sharp end".

Green alternatives like a biofuel or hydrogen refinery are seen as "a long way over the horizon" and would require fewer workers than the traditional industry. This isn’t just a question of skills training and investment - fundamental issues of physics that place limits on the potential for hydrogen to be an economic store of energy.

A report from Robert Gordon University (RGU) warns that the UK risks losing tens of thousands of offshore energy jobs by 2030 without urgent, coordinated action. The UK oil and gas workforce is forecast to fall from 115,000 in 2024 to between 57,000 and 71,000 by the early 2030s. In a low-case scenario, the North Sea oil and gas workforce could shrink by about 200 jobs every week for the next five years. This poses substantial risks, particularly for Scotland, where nearly 1 in 30 of the working population is employed in or supports the offshore energy industry.

Sabic, a major manufacturing and chemicals firm, is closing its Olefins 6 cracker plant in Wilton, Teesside, after 46 years, potentially leading to hundreds of job losses from its 330 employees at the site. This decision was driven by the company's aim to "optimise competitiveness" amidst high energy costs and geopolitical instability, despite reporting a net profit of almost £300 million last year.

General manufacturing distress

From the Administration List:

The UK manufacturing sector recorded over 1,500 insolvencies last year, making it one of the top three most affected sectors.

Overall business closures surged in Q1 2025, with 2,718 companies shutting down, the highest first-quarter total since 2021.

Manufacturing output fell by 0.8% month-over-month in March 2025, with significant declines in production of computer, electronic, optical products, pharmaceuticals, and basic metals.

Sky-high electricity prices are a critical factor making UK industries uncompetitive globally, with UK businesses paying significantly more for electricity than their European counterparts. This contributes to falling export orders and lost contracts.

Another recent example is the pottery firm Moorcroft, an historic company operating for over a century in Stoke-on-Trent, ceased trading with the loss of 57 jobs. Rising energy bills and competition from cheaper imports were cited as key reasons for its closure.

Other factors adding to economic strain include a £25 billion increase in employers’ National Insurance contributions, increased minimum wages, global trade wars, and US import tariffs, which are forecast to reduce economic growth by 0.8% over the next two years. The British Chambers of Commerce (BCC) warned that the tax hike is a "toxic reality" for businesses, leading many to scale down investment or cut hiring.

Meanwhile in the Clean Technology Sector

While traditional sectors decline, the UK is attempting to perform a radical technological shift towards electric vehicles and renewable energy, and is facing significant challenges.

Wigan-based Electric Glass Fiber UK (EGFU) is set to close after its Japanese owner NEG failed to clinch a rescue deal for the company and its 250 workers. It makes vital components used in wind turbines and electric cars. The business said rising energy prices were putting pressure on operations. Its closure puts net zero supply chains under threat.

Britishvolt, the UK battery start-up, collapsed into administration with the majority of its 232 staff made redundant.

The Society of Motor Manufacturers and Traders (SMMT) explained that the ICE→EV transition means the decline of ICE-related supply chains, putting at least 22,000 jobs, £11 billion turnover, and £2 billion Gross Value Added at stake. Components like conventional gearboxes, clutches, and exhaust systems will become redundant. Studies suggest that only about 45% of lost ICE jobs might be replaced by EV-related roles, leading to a net loss of jobs.

The UK automotive sector faces exceptionally high electricity prices, which are the highest in Europe and 59% higher than the EU average. This undermines investment and competitiveness in battery manufacturing and the broader transition to electrified vehicles.

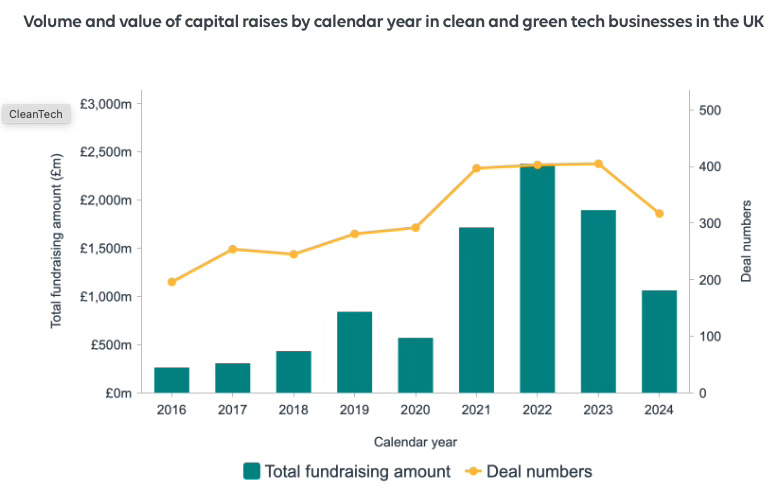

More generally, Price Bailey reported a 44% drop in clean tech investment in 2024. According to data obtained by Price Bailey from market insights platform, Beauhurst, the Green and Clean Tech sector saw an investment peak of £2.4bn in 2022, a 39% increase from 2021. However, after a 20% drop in 2023, investments plummeted by a further 44% in 2024 to just £1.1bn.

Others are commenting on the end of the boom for clean tech. For exampl,e the World Future Energy Summit said:

Traditional investors essentially want two things – quick returns and manageable risks. Climate tech is not known for offering either of them. Unlike software companies and digital consumer goods where growth curves are steep and rapid, development cycles in climate tech can take many years or even decades to complete.

This explicit recognition of the long term challenges for clean tech is something our government has not grasped. They set wholly unrealistic NetZero targets without accounting for the obvious pressure on business on consumers. And it’s not as is we didn't predict this. So why is the government taking such an extreme approach? Particularly, a supposedly socialist government that came into being to represent workers?

There is a saying in the IT sector which is “eating your own dog food”, describing the situation when companies use their own products and services internally, demonstrating their quality and confidence in them. Ironically, a key factor hitting the clean energy sector is excessive energy costs. It appears that the clean energy sector is deep in what comes out of the dog rather than what goes in.

Impact on other sectors

As regards the rest of the economy, the Forbes Burton’s UK’s Distressed Business List swelled to 200 in 2024. They noted:

With trading conditions so difficult for bars and breweries, it’s no surprise to see that bubbles have been burst somewhat. Breweries call for large premises and even bigger energy bills.

There are clearly many other factors affecting UK Business not least of which are the rises in Employer’s National Insurance and the Minimum Wage. However, it’s impossible to escape the fact that every business, in fact every large organisation, has significant energy costs. If the UK continues to have the most expensive industrial energy in the world then is it any surprise that businesses are struggling?

Why the Clean Energy Transition is not working for anyone

We are seeing a rocky, uncoordinated transition that is not benefiting many stakeholders.

The rapid decline and job losses in traditional sectors like oil and gas are accelerating faster than the renewables and EV manufacturing sectors can absorb displaced workers. In the interim period between 2025 and 2030, where urgent action is needed, there is limited capacity to transfer oil and gas workers to renewables in the near term, pushing workers onto the scrapheap.

A consistent and pervasive problem is the UK's exceptionally high electricity prices, which are the highest in Europe and 59% higher than the EU average. This significantly impacts manufacturing competitiveness across the board, deters investment, and raises costs for all sectors.

As the BBC’s Douglas Fraser points out, the concept of a "just transition" for energy workers is not being met in practice, as green alternatives like biofuels or hydrogen refineries are "a long way over the horizon" and would require fewer workers than the traditional industries they replace.

Beyond energy costs, UK businesses face rising National Insurance contributions, increased minimum wages, global trade wars, and US import tariffs. These pressures contribute to a surge in insolvencies across various sectors, including retail and pubs, further weakening the overall economic landscape for transition. The UK manufacturing sector also faces the highest goods price inflation and some of the worst supply chain delays globally.

It is pointless for governments to blame issues other than energy costs as the reason why businesses are failing. If energy was 4 times lower, matching prices in the US for example, then all businesses would be much more resilient to external pressures. And of course, it’s not just business. Cash strapped public services would benefit massively from cheaper energy.

Summary

While the UK is pushing towards a clean energy future, the transition is proving financially burdensome, economically disruptive, and socially challenging. This is due to high operating costs, global competitive pressures, and what many see as inadequate and uncoordinated governmental support and investment.

This disconnect means that job losses in traditional sectors are not being seamlessly offset by new opportunities, and new industries face hurdles that make rapid, smooth growth difficult. This is leading to a situation where the clean energy transition currently appears to be working for very few in the UK.

As has been said before, we are in the process of “shooting the horses” just when the first automobiles sputtered into life.