The DESNZ explains why renewables seem so cheap

A look into the implications of their report "Electricity Generation Costs 2023"

A short post to look at this report from the Department of Energy Security and Net Zero which helpfully explains the real costs of renewables. From the introduction to the report:

Electricity generation costs are a fundamental part of energy market analysis, and a good understanding of these costs is important when analysing and designing policy to make progress towards net zero.

Yes indeed - it’s just a shame that Ed Miliband doesn’t live by this advice when he states that electricity costs are fixed to wholesale gas prices. This is simply not true. There have been times when they have been more influential, principally during the early party of the Russian invasion of Ukraine. However, wholesale prices have fallen back since then. We still have the highest industrial electricity prices in the developed world and the fourth highest domestic prices.

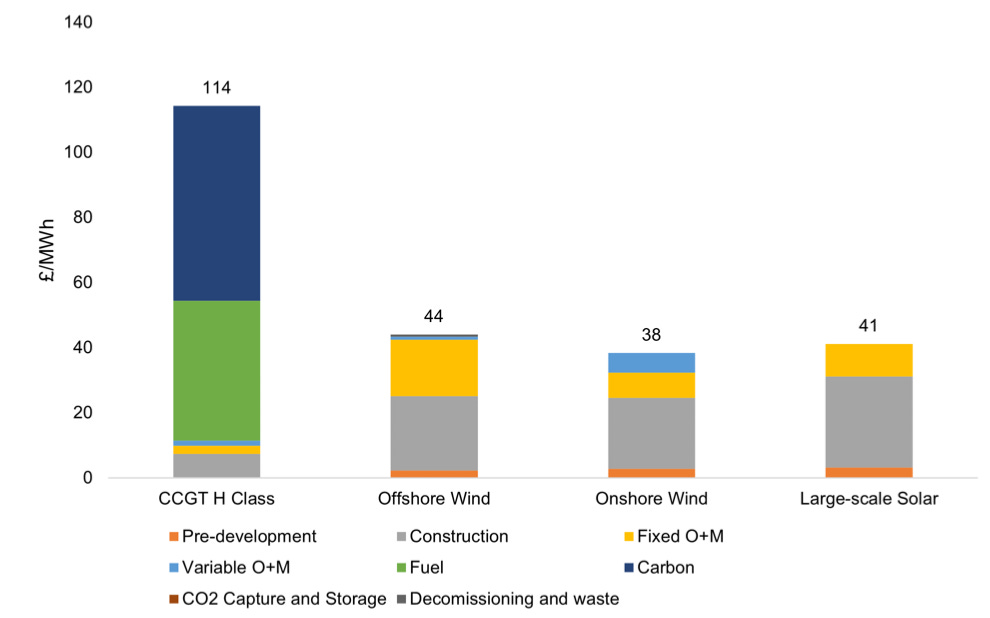

I recommend reading the whole report, but it’s instructive to look at just one of the charts. Figure 2 presents the relative costs of gas power (CCGT) compared to offshore wind, onshore wind and large-scale solar for projects commissioning in 2025 (in 2021 prices):

Table 10 of the report provides a detailed breakdown of the figures, but several things stand out:

For gas (CCGT H Class), the government imposed carbon tax is over half of the total cost and 140% of the fuel cost! This carbon tax is set to rise significantly as other charts in the report show.

Fuel cost is the only category where renewables are cheaper, where most other costs are significantly lower for gas.

So how do we read this? Certainly renewable fuel is cheaper but on every other metric apart from carbon tax, the costs are greater. Granted, even if we were to remove ALL the carbon tax, renewables would still be cheaper.

However, we also know from the introduction to the report that:

Levelised costs provide a straightforward way of consistently comparing the costs of different generating technologies with different characteristics, focusing on the costs incurred by the generator over the lifetime of the plant. However, the simplicity of the measure means that there are factors which are not considered, including a technology’s impact on the wider system given the timing, location, and other characteristics of its generation.

I previously discussed this issue in my article Why the Renewables Industry Loves LCOE. The chart above takes no account of the facts that renewable energy is intermittent and requires reliable backup. This backup is typically in the form of gas fired power and foreign inter-connector supplies. Given that such power has to be bid for in a highly complex market, it is not surprising that costs per MWh can rise dramatically. This can sometimes go up to several thousands per MWh. Compare this to the wholesale cost of gas from the chart above, which is £43/MWh.

So what else doesn’t this chart show? For a start it takes no account of quality of energy supplied. There are a number of ways to measure this including availability (and ability to despatch when required), efficiency and more technical issues such as supporting better grid stability through a property called inertia. Inertia relates to the presence of large rotating masses which are vital to keep the grid operating at a stable frequency.

There are also social issues such as number and quality of long term jobs created. Having studied company reports from wind farm operators it’s clear that they provide little in the way of high quality or local permanent employment. In the case of Scout Moor I, a local wind farm, there were zero permanent employees in the last two sets of accounts. Presumably all maintenance is carried out by specialist contractors.

We also need to consider the impact on the environment. This includes the amount of land required, the impact on peat and wild life, and ease of decommissioning. On all these counts, gas is significantly better and in most cases, orders of magnitude better.

The final factor to consider is something called Energy Return on Energy Invested or EROEI. I wrote about this in Does “The Iron Law of Energy” mean that we are doomed? EROEI is the ratio of energy output to the energy input required to produce it. The lower the value then the less practical or economic is a power source. Unsurprisingly, renewable energy has much lower EROEI values than fossil fuel or nuclear.

Summary

If we remove the carbon tax, the relative levelised costs are similar, with gas being only slightly more expensive. However, to understand the full picture we need to acknowledge that fossil fuels:

Require significantly less backup

Provide inherently better quality energy

Are much less damaging to the environment

Require much less land per MWh produced

Provide more and better quality jobs, including locally

Generate significantly more energy that is required to produce it

Paradoxically, we have a Net Zero policy with the goal to dramatically increase renewable energy supply whilst taxing to death the fossil fuel power sources that make renewable energy a possibility in the first place!

At some point, which must be approaching rapidly, the pressure on fossil fuel prices, particularly growing carbon taxes, must lead to energy so expensive that it will be impossible for society to function. This is not hyperbole. It’s just the logical conclusion of an insane and out of control energy policy.

And remember, this analysis is based on official government data, not a partisan fossil fuel report. I am more than happy to be corrected in the comments, but I can’t see any justification for Net Zero policy. We know for example, that since our emissions are so low, it could never reduce global temperatures. And as I wrote about in UK Climate Leadership: Are We Leading Everyone Off a Cliff?, and should be obvious from the above, being a climate leader is a futile. It’s just virtue signalling.

And it would not matter if we tried to do it slower. The fundamentals of physics, engineering and economics are not going to change. In some respects the sooner we hit the buffers, the sooner the penny will drop and we can start thinking about how we are going to get back to sanity. It will be a major challenge.